Investing in Election Years

With the US election fast approaching, many investors are growing increasingly wary of potential turbulence in the market.

The implications of a Trump or Harris presidency vary greatly, with contrasting policies on everything from trade tariffs to climate change. However, for markets, the impact is often less than dramatic. By Conor Murtagh, Investment Associate, Davy.

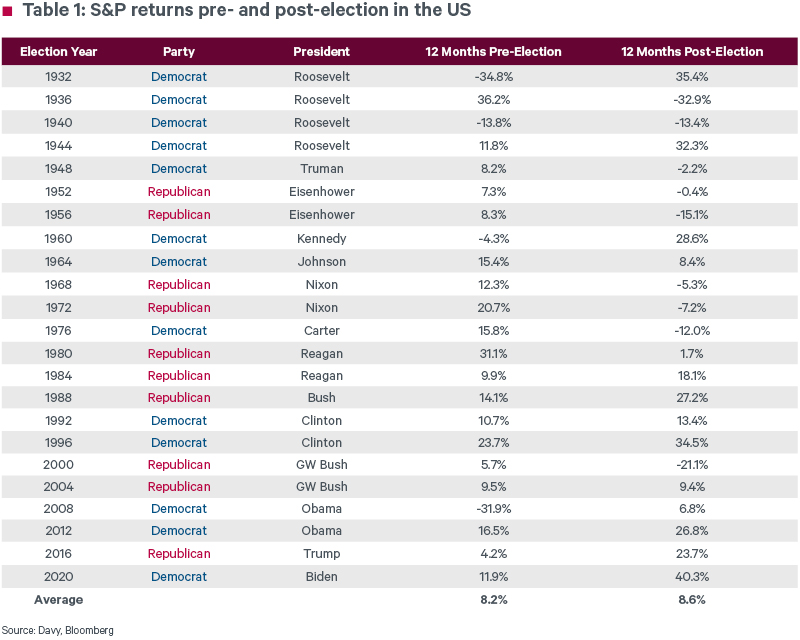

In Table 1 below, we look back on previous elections beginning with Roosevelt’s first term in 1932. We can observe that, on average, the S&P 500’s returns in the 12-month period before and after elections do not materially differ. Even when compared to non-election years, we don’t typically see abnormal returns in US markets – for non-election years the mean return is 9.28%, while in years with an election we see a mean return of 8.85%.

During the 2016 race, investors clamoured over a number of so-called “Trump Trades” in an attempt to profit from the result of the election. This involved investing in industries which were set to benefit from a Trump victory, including banks, energy providers, and defense companies. Although some of the trades briefly succeeded in the days following the election, most failed to work at all.

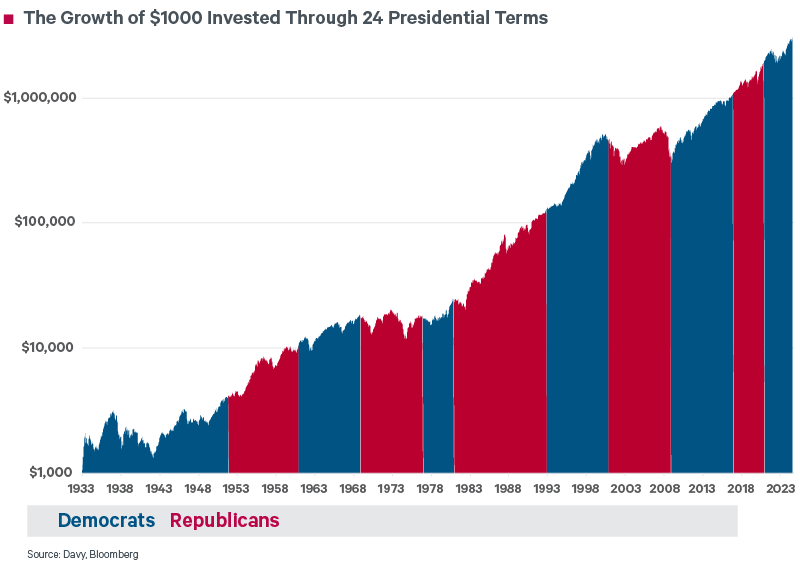

Positioning investments around elections is difficult to get right and often leaves investors worse off than they previously were. From the chart below, it’s clear that, in the long run the winning strategy for investors has been staying invested, regardless of who is in the White House. The relentless growth of US equities has been agnostic to politics and will likely continue to be, no matter the result on 5 November. While election years can spur uncertainty in demand for steel, the impact on the construction industry will depend on policy and economic decisions. Clarity following an election can reinvigorate positive sentiment.

Figure 1

Stay informed on the impact of US elections on investments here.