The global interest rate cutting cycle begins

Major central banks around the world have come to the end of rate-hiking cycles and have now turned their attention to rate cuts.

The European Central Bank went first by cutting rates in early June.

Markets expect the Federal Reserve (The Fed) in the US and the Bank of England in the UK to follow suit later this year.

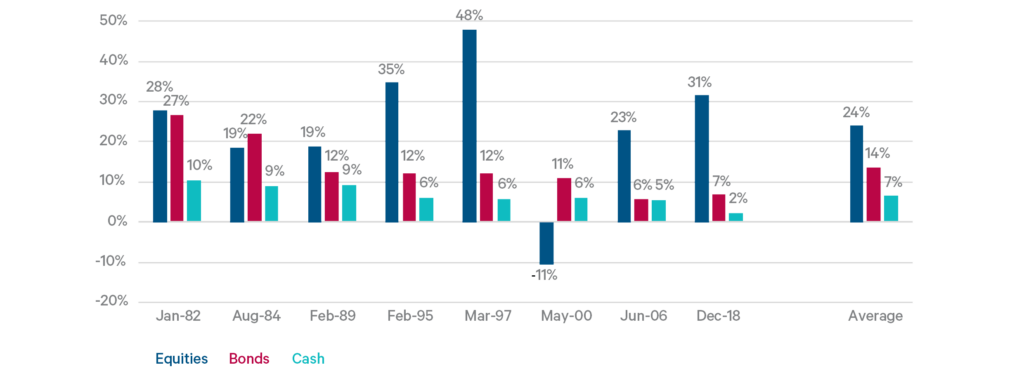

Performance of bond and equity markets 12 months after the last rate hike.

Historically, asset class performance after rates have peaked has been strong. The chart above shows asset returns after the completion of previous US Federal Reserve rate hiking cycles. Traditionally, equities have been the strongest performers in these periods. The prospect of lower rates (or at least not higher rates) reduces the discount rate at which company earnings are valued, boosting share prices. Bonds have also performed well after rates peak. Bond yields and prices are inversely related, this means that bond investors make price gains as yields fall.

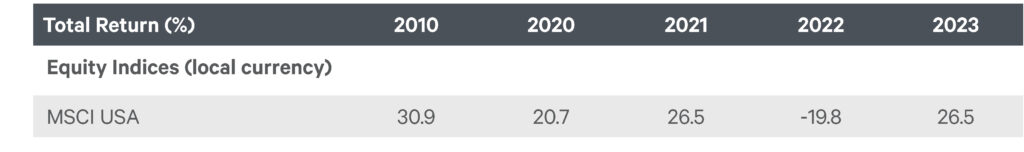

The Federal Reserve made its final rate hike in July 2023. Since then, US equities have rallied 16% (as of 31 May), boosted by the excitement surrounding artificial intelligence. Bond returns have been less attractive. Bond yields have actually increased in the US year to date as inflation has proved to be stickier than expected. Investors expected about six rate cuts in 2024 at the start of the year, they now only expect one or two rate cuts before year-end.

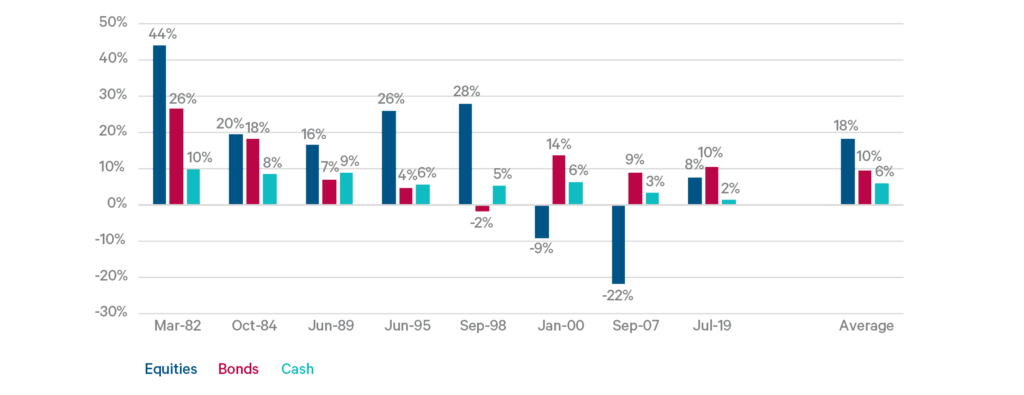

When rate cuts do eventually come in the US, it should be a good thing for investors in multi-asset portfolios. The chart below shows historical performance after the first Fed rate cut. Overall, returns were strong after the first rate cut except for January 2000 and September 2007. Both of those rate cuts were closely followed by recessions, this explains the weak performance of equities in those instances.

Performance of bond and equity markets 12 months after the last rate cut.

This year’s rate cuts are coming at a time when labour markets are still tight, growth has been surprising to the upside and inflation is under control. Rate cuts are a positive development for investors in multi-asset portfolios and will be an important driver of returns going forward.

High interest rates have meant it has been more difficult to secure affordable funding in the construction industry. As rates show signs of being cut, it might be worth enquiring how this will affect your business going forward. To find out more, reach out to a Davy adviser.

The article was prepared by Scott McElhinney, Investment Strategist at Davy.

Warning: Past performance is not a reliable guide to future performance. The value of your investment may go down as well as up.

Warning: Forecasts are not a reliable indicator of future performance.

Warning: The information in this article is not a recommendation or investment research. It does not purport to be financial advice and does not take into account the investment objectives, knowledge and experience or financial situation of any particular person. There is no guarantee that by putting a financial or investment plan in place, you will meet your objectives. You should speak to your advisor, in the context of your own personal circumstances, prior to making any financial or investment decision.